Israel

Although Israel does not produce significant amounts of energy,

it is located strategically for regional energy transit and also is an important

variable in the Middle East security situation.

Information

contained in this report is the best available as of May 2002 and is

subject to change. GENERAL

BACKGROUND

GENERAL

BACKGROUND

Israel currently is facing

significant political and economic challenges. Most importantly, the severe flareup in Palestinian-Israeli violence

since September 2000 has cost Israel hundreds of lives and battered its

economy, which had experienced a high-tech-driven boom and 6% annual real

economic growth for much of the 1990s. In response to a widening

budget deficit (to 4.6% of gross domestic product -- GDP -- in 2001) caused

by increased military spending, reduced tax receipts, and increased welfare

spending due to the weak economy, the Israeli government has drafted a $2.7

billion, emergency economic austerity package which would cut spending

(including reduced subsidies and welfare payments) and raise taxes

(including imposition of a capital gains tax), among other things. Even if

this plan passes Israel's parliament (the Knesset), the Israeli economy is still

expected to remain flat or to contract by 2% in 2002. The Bank of Israel

has estimated that a continuation of violence and heightened security measures

through the end of 2002 will reduce Israel's economic growth by 3.5%-5% from

where it would have been. Israel's economy also continues to be

adversely affected by slowdowns in the global high-technology sector and in the

U.S. economy.

Israel's unemployment rate has risen sharply in recent months, reaching 10.2% in the fourth quarter of 2001. Meanwhile, Israel's currency -- the shekel -- has depreciated, the trade deficit has deteriorated, and more than 50,000 Israeli businesses reportedly have gone bankrupt. The Bank of Israel has attempted to stimulate the Israeli economy by cutting interest rates, but this most likely will not continue due to fears of inflation.

Prior to the current round of Palestinian-Israeli violence, Israel had undertaken important structural reforms (such as privatization and reduced controls on foreign currency exchanges and profit remittances by foreign companies), although public spending still accounts for more than half of the country's GDP and the top marginal income tax rates exceed 60%. Israel also had been making great progress in attracting tourism and foreign investment, but both of these are now down sharply (50% and 39%, respectively, in 2001 compared to 2000). Finally, Israel had been making halting progress towards privatizing government-owned companies, including banks, the state telecommunications company (Bezeq), and others. Given the ongoing Palestinian-Israeli turmoil, privatization and economic reform in general are now essentially on hold.

ENERGY

Until recently, with a

significant offshore natural gas discovery, Israel has had essentially no

commercial fossil fuel resources of its own, and has been forced to depend

almost exclusively on imports to meet its energy needs. Israel has attempted to

diversify its supply sources and to utilize alternatives like solar and wind

energy. Traditionally, Israel has relied on expensive, long-term contracts with

nations like Mexico (oil), Norway (oil), the United Kingdom (oil), Australia

(coal), South Africa (coal), and Colombia (coal) for its energy supplies. Israel

also has pursued other, cheaper sources of energy, like Egyptian gas, and hopes

to expand natural gas significantly as a percentage of its energy mix in coming

years.

Although the Israeli government in principle favors privatization of state-owned companies, the energy sector remains largely nationalized and state-regulated, ostensibly for national security reasons. In fact, little progress on energy sector privatization has been made since the late 1980s, when Paz Oil Company (the largest of three main oil-marketing companies in Israel) and Naphtha Israel Petroleum (an oil and gas exploration firm) were sold to private investors. Meanwhile, other energy companies such as the Oil Refineries Company, which operates Israel's two refineries (at Haifa and Ashdod), and the Oil Products Pipeline Company, which operates Israel's oil pipelines, remain state-owned, with no definite plans to privatize them in the near future (although the current Israeli government appears to favor such privatization, at least in principle). In early 1996, the Israel Electric Company's (IEC)'s monopoly was extended for another 10 years.

In February 2000, Israel and the United States signed an energy cooperation

agreement. The agreement includes cooperation in the fields of gas, coal, solar

power technology, and electric power generation. In addition, the two countries

signed a letter of intent with Israel's Atomic Energy Commission to expand

cooperation on nuclear non-proliferation and arms control issues. In May 2001,

the Bush Administration announced that it would honor this agreement.

OIL

Israel produces almost no oil and

imports nearly all its oil needs (major sources traditionally have included

Egypt, the North Sea, West Africa, and Mexico). Although oil exploration in

Israel has not proven successful in the past (current output is less than 1,000

barrels per day), drilling is being stepped up. Israel's Petroleum Commission

has estimated that the country could contain 5 billion barrels of oil reserves,

most likely located underneath gas reserves, and that offshore gas potentially

could supply Israel's short-term energy needs. Geologically, Israel appears to

be connected to the oil-rich Paleozoic petroleum system stretching from Saudi

Arabia through Iraq to Syria.

Overall, around 410 oil wells have been drilled in Israel since the 1940s, with little success. In early 1998, the Jerusalem Post reported that several Israeli oil companies intended to explore for oil in waters offshore Israel's coast, and several foreign oil companies have expressed interest recently in this area. In late September 2000, for instance, a contract was signed between U.S.-based Ness Energy International and Lapidoth Israel Oil Prospectors Corp. to commence further work on the Har Sedom 1 well. In 1994, Enserch Corp. of Dallas signed an agreement with two Israeli companies to examine a 1,500 square mile area on the Mediterranean coast. In another development, Isramco (a private company which absorbed the Israel National Oil Company when it was privatized in 1997), Delek, and Naphtha Israel Petroleum Corp. are partners in the Gevim 1 oil well being drilled near Sderot in the Negev desert. Isramco has stated that it is optimistic that the Gevim field will yield significant amounts of oil. Meanwhile, oil was discovered near the Dead Sea town of Arad in August 1996, and is currently flowing at the rate of about 600 barrels per day. In October 2001, Ness Energy announced that it was exploring for oil in the Masada Lease near the Dead Sea.

The $1.3 billion, 100,000-bbl/d, Egyptian-Israeli joint venture MIDOR (Middle

East Oil Refinery Ltd.) refinery in Alexandria, Egypt began operations in April

2001. The ultra-modern, environmentally-advanced facility includes a

25,000-bbl/d hydrocracker. In early June 2001, Israel's Merhav confirmed that it

had sold its 20% share in MIDOR to the National Bank of Egypt, making the

refinery 100% Egyptian owned. Merhav's sale effectively marked the end of what

had been the largest Arab-Israeli joint venture to date. Although Merhav claimed

that the sale was made solely for business reasons, most outside observers and

analysts believed that political considerations were a major factor.

Although Israel itself produces almost no oil, a comprehensive settlement of

the Arab-Israeli conflict could affect Middle East oil flows significantly.

Israel's geographic location between the Arabian peninsula and the Mediterranean

Sea offers the potential for an alternative oil export route for Persian Gulf

oil to the West. At present, these oil exports must travel either by ship

(through the Suez Canal or around the cape of Africa), by pipeline from Iraq to

Turkey (capacity 1-1.2 MMBD), or via the Sumed (Suez-Mediterranean) Pipeline

(capacity 2.5 MMBD). Utilization of the Trans-Arabian Pipeline (Tapline) could

offer another potentially economic alternative. The Tapline was originally

constructed in the 1940s with a capacity of 500,000 bbl/d, and intended as the

main means of exporting Saudi oil to the West (via Jordan to the port of Haifa,

then part of Palestine, now a major Israeli port city). The establishment of the

state of Israel resulted in diversion of the Tapline's terminus from Haifa to

Sidon, Lebanon (through Syria and Lebanon). Partly as a result of turmoil in

Lebanon, and partly for economic reasons, oil exports via the Tapline were

halted in 1975. In 1983, the Tapline's Lebanese section was closed altogether.

Since then, the Tapline has been used exclusively to supply oil to Jordan,

although Saudi Arabia terminated this arrangement to display displeasure with

perceived Jordanian support for Iraq in the 1990/1 Gulf War. Despite these

problems, the Tapline remains an attractive export route for Persian Gulf oil

exports to Europe and the United States. At least one analysis indicates that

oil exports via the Tapline through Haifa to Europe would cost as much as 40%

less than shipping by tanker through the Suez Canal. In the meantime, Israel has

one main operational oil pipeline, known as the "Tipline," which runs from the

Red Sea port of Eilat to Haifa (via the Mediterranean port of Ashqelon).

NATURAL GAS

Israel hopes to increase the

share of natural gas in its fuel mix (especially for electricity generation,

currently dominated by coal-fired plants) for energy security, economic, and

environmental reasons, and has been looking at various options in recent years.

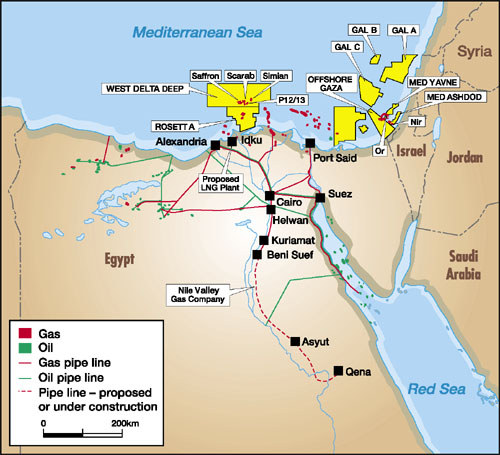

One possibility is gas imports from Egypt's Nile Delta and offshore regions,

either overland across the Sinai peninsula, or via underwater pipeline to the

Israeli coast. Another strong possibility, which has arisen only in the past

year or so, is using Israel's own, newly-discovered offshore gas resources.

As far as Egyptian gas is concerned, the East Mediterranean Gas (EMG) Company (a consortium of EGPC, Merhav of Israel, and Egyptian businessman Hussein Salem) has been set up to pursue this option. ENI, a major gas producer in Egypt, is nearly through construction on a $150-million gas pipeline from offshore fields north of Port Said, Egypt through the Sinai to El-Arish, near the border with the Gaza Strip, and only about 30 miles from Israel. Using Egyptian gas for power generation in the Palestinian Authority reportedly would cost 3.5 cents per kilowatt-hour, about half the price charged by the IEC. Currently, Gaza is almost totally dependent on the IEC for its electricity needs. Although Egypt and Israel announced a deal in early 2001 whereby Egypt would supply $3 billion worth of gas to Israel through 2012, in recent months the likelihood of Egyptian gas exports to Israel has decreased due to political factors, specifically the continuing Israeli-Palestinian conflict. There are also national security concerns in Israel over becoming too dependent on energy imports, especially from any one source. Egypt is now talking about exporting its gas directly to Jordan via 'Aqaba, although without Israel, the major potential regional market for Egyptian gas exports, the economics of this appear questionable.

Over the past two years, in an important development for a country which has never had significant domestic energy resources, several energy companies (Israel's Yam Thetis group, Isramco, BG, and U.S.-based Samedan) have discovered significant amounts of natural gas off the coast of Israel (and even more off the Gaza Strip). Initial estimates of 3-5 trillion cubic feet (Tcf) in proven reserves would be enough potentially to supply Israeli demand for years, even without natural gas imports, although this now seems optimistic. Israel's new offshore gas reserves belong mainly to two groups: 1) the Yam Thetis group (comprising the Avner Oil, Delek Drilling, and Noble Affiliates' Samedan subsidiary); and 2) a BG partnership with Isramco and others. In August 2000, Isramco/BG announced that it had discovered a large gas field 12 miles offshore at its Nir-1 well. The field reportedly contains gas reserves of 274 Bcf, and represents the third gas field discovered offshore Israel during 2000 (the largest two being Mari and Noa, with combined reserves of nearly 1.5 Tcf). In early September 2001, Isramco announced that BG was abandoning the Tommy, Orly, Shira and Aya concessions after analyzing geological and geophysical findings.

All else being equal, Israel appears to prefer utilizing domestic gas resources as opposed to imports from Egypt. Meanwhile, Israel's Yam Thetis gas consortium reportedly has been lobbying against Egyptian gas imports. In a related development, in June 2001, the Israeli Supreme Court ruled that Yam Thetis did not have a vested right to build a gas pipeline from its offshore reserves to IEC coastal power facilities, leaving open the option for possible competitors. In early May 2002, however, Noble Energy announced that it had obtained a license from the Israeli government to construct a pipeline from Mari-B to Ashdod. Field development and the pipeline are scheduled for completion by late 2003. Flow rates of 600 million cubic feet per day of natural gas are possible.

Several groups have

been competing to supply gas to the IEC, including Yam Thetis and Isramco/BG,

plus EMG and local group Sdot Yam. In January 2001, IEC said that it would award

EMG a significant share of its gas contracts, in large part because EMG's

prices, at around $2.50 per 1,000 cubic feet, reportedly were 20%-30% below

other offers. In May 2001, EMG reportedly was in an advanced stage of

negotiations with IEC on supplying around 60 Bcf of gas per year for 10-15

years. However, as of June 2001, gas supplies from EMG were in doubt due to

reports that Egypt was considering backing out of any gas deal with Israel. In

March 2001, IEC announced that remaining gas supplies would come from Yam

Thetis. In February 2001, Egypt's oil minister denied that any agreement had

been reached on Egyptian gas sales to Israel. In early May 2002, IEC

announced that it could begin taking delivery of natural gas from Yam Thetis as

early as the second half of 2003. The gas would be delivered to IEC's

Ashdod power station. IEC also agreed to purchase half of its natural

gas requirements from the Yam Thetis consortium, at a cost of $1.5-$2.5 billion

over 11 years.

The other half remains uncertain, particularly since Belgium's Tractebel indicated in April 2002 that it wanted to withdraw from a $400 million project to construct a natural gas distribution network in Israel due to security concerns. Tractebel, which holds a 60% stake in the project consortium, had been the only bidder on the project, which was awarded in December 2001, and its expertise is considered crucial to the project. If Tractebel does pull out, which is not a certainty as of early May 2002, possible alternatives reportedly include Russia's Gazprom, BG, El Paso, and Slovakia's SPP. Israel's National Infrastructure has requested that Paz Oil and Africa Israel Investments, each of which held a 20% stake in the Tractebel consortium, come up with a replacement for Tractebel by mid-May. In December 2001, the Israeli Knesset passed a law setting up an Israeli Gas Co. to build and operate the national gas grid.

In May 2001, Yam Thetis indicated that it would invest $235 million through

2003 in building a gas production and distribution system from its Mari field to

the coast at Ashkelon. Yam Thetis also said that it did not plan at the current

time to produce gas from its Noa offshore gas field, which is significantly

smaller and more distant than Mari.

Meanwhile, gas has been discovered not only on Israel's side of the border,

but also in areas that appear to lie in Palestinian territorial waters off the

Gaza Strip. BG has signed a 25-year contract to explore for gas and set up a gas

network in the Palestinian Authority. In December 2000, BG successfully

completed drilling a second gas well offshore Gaza. The drilling confirmed

findings from the Marine 1 well, which had flowed at 37 million cubic feet per

day, indicating possible reserves of around 2 Tcf. BG reportedly plans to

invest $400 million in its offshore Gaza gas finds.

COAL

Israel meets approximately 30% of its

energy demand requirements from coal (primarily for electric power generation).

The National Coal Supply Corporation (NCSC) is the majority government-owned

(74%) company, established in 1981, solely responsible for securing the

country's coal imports. In March 2001, the Israeli government approved the sale

of NCSC to the IEC, which already owns 26% of the company. Israel's coal

supplies are all imported. In 2001, about 47% of these imports came

from South Africa, with the rest from Colombia (21%), Australia (16%),

Indonesia (16%), the United States and Poland. NCSC reportedly is

attempting to diversify supply sources away from heavy reliance on South

Africa. As part of this effort, coal from the United States was to be

tested at the Ashkelon power plant in 2001. This year, Israel also is

planning to import coal from Poland and China for the first time.

Overall, Israel imports around 10 million short tons (Mmst) of coal. Growth in coal demand (and imports) is being driven mainly by rapid growth in electricity demand. A new coal terminal opened at Ashkelon in 2000 to handle coal imports for Israel's two coal-fired power plants located there.

ELECTRICITY

According to the IEC (Israel's

monopoly national utility), Israel had about 9.1 gigawatts (GW) of installed

electric generating capacity (at 20 power stations, including 7 major

thermal plants) as of 2000, with nearly 70% accounted for by coal-fired plants,

25% by fuel oil-fired units, and the remainder by gasoil and independent power

producers (IPPs). Israel also is a world leader in solar technology and

relies heavily on solar energy for water heating. The 1,645-mile, IEC

transmission grid is a closed loop system connecting power stations to major

load centers throughout Israel and to the Palestinian Authority. The

system inclues EHV-400 KV transmission and 161 KV sub-transmissions systems, and

serves 2.1 million customers, of which 1.8 million are residential.

Prior to the country's recent economic difficulties, electric power consumption had been increasing rapidly (around 4%-5% annually; 13% in 2000), and the IEC estimates that this growing power demand will require an increase in production capacity to nearly 12 GW by 2005. By 2010, IEC foresees installed generating capacity reaching 15.3 GW. To meet this increased demand, IEC is aiming to raise $1.2-$1.3 billion a year in financing for generation, transmission, and distribution systems. The IEC is converting its oil and diesel-fired generators to natural gas, and hopes to generate 25% of its electricity from gas by 2005. The source of the natural gas most likely will be either via pipeline from Egypt and/or from Israel's own offshore gas reserves. Natural gas would serve at least three goals: increased diversity in energy sources; benefits to the environment; and reductions in IEC's electric generation costs. In March 2002, IEC approved the acquisition of three combined cycle power generating units from Siemens AG of Germany for $341 million. This will enable Israel to utilize both natural gas and diesel fuel at the Gezer and Haifa power stations.

Israel's fourth coal plant, the Rutenberg facility at the Mediterranean Sea port of Ashkelon, was inaugurated on June 29, 2000. Rutenberg is the first power plant in Israel to have sophisticated anti-pollution scrubbers (Israel intends to install scrubbers at its two coal-fired plants in Hadera as well). In total, Rutenberg is to have four 550-MW generators, for a total production capacity of 2,200 MW. In late August 2001, Israel's Infrastructure Ministry granted final approval for construction of the country's fifth coal-fired plant. The plant, which was initially rejected two years ago, could go into service as early as 2007 at a cost of $1.3 billion, most likely at Ashkelon, location of the Rutenberg facility. Meanwhile, a new coal dock at Ashkelon began operating in late 2000, saving IEC around $40 million a year in coal transportation costs. Previously, coal was shipped to another port, Ashdod, unloaded, and sent by rail to Ashkelon.

Besides fossil fuels, Israel also is looking at other indigenous options, including oil shale from Nahal Zin in the Dead Sea region and renewables (particularly solar power). At the present time, nuclear power is not considered an option for at least 20 years (although Israel already operates a nuclear reactor at Dimona, in the Negev Desert 25 miles west of the Jordanian border, as well as a smaller research reactor at Nahal Sorek south of Tel Aviv).

As part of an effort to increase privatization of the country's power sector, Israel's Ministry of Energy has directed IEC to purchase at least 900 MW of power from IPPs by the year 2005 (of which possibly 150 MW are expected to come from solar and wind facilities, with the rest mainly natural gas-fueled). Israel's goal is for 10% of all electricity to be produced by IPPs. In June 1997, IEC announced the first tender for a large-scale private power plant in Israel -- a 370 megawatt, dual-fired, combined-cycle plant to be built at Ramat Hovav (by a consortium of PSEG Global and the OPC energy company) in the Negev Desert by 2002. In March 2001, OPC signed a contract with Siemens of Germany to purchase $200 million worth of gas turbine equipment for the plant, which is under construction. In July 1998, the first IPP tender issued by the IEC was awarded. A second and third IPP are possible, including the 400-MW, gas-fired Alon Tavor power plant in northern Israel.

One area of potential regional cooperation involves integration of individual

national power transmission grids into a regional power network. Such a network

would, among other benefits, allow power companies to take advantage of

differences in peak demand periods, reduce the need for (and the costs

associated with) installation and maintenance of reserve generating capacity,

and provide outlets for surplus generating capacity (mainly from Israel to

Jordan). Israel and Jordan held talks in October 1999 regarding possible

cooperation on a shale-oil-fired plant as stipulated in the two countries' peace

treaty. The two countries also have talked about linking their power grids and

have discussed several proposed joint power stations, including a $1-billion,

1,000-MW plant to be located on the two countries' border, a 100-MW wind farm, a

150-MW solar thermal plant in the southern Arava desert near Eilat, and an

800-MW plant in Jordan that would supply power to Israel. In addition, IEC has

developed plans for potential joint wind power development with Syria in the

Golan Heights region should a peace treaty be signed. IEC estimates that up to

10% of future electric supplies could come from outside the country.

IEC plans to spend about $1 billion over the next ten years to help reduce

emissions from its power plants. New coal plants are to be equipped with flue

gas desulphurization and combustion systems, and most of IEC's existing gas

turbines have been retrofitted with low nitrogen combustion systems. Most of the

coal ash waste produced by IEC's three coal-fired power plants is sold to the

cement industry.

Sources for this report include: AP Worldstream; Agence France Presse; Associated Press, BBC Summary of World Broadcasts; CIA World Factbook 2001; Coal Week International; Dow Jones News Wire service; DRI/WEFA; Economist Intelligence Unit Country Reports, ViewsWire; Financial Times; Global Power Report; Ha'aretz; Hart's Africa Oil and Gas; International Herald Tribune; Jerusalem Post; Middle East Economic Digest; New York Times; Oil and Gas Journal; Petroleum Intelligence Weekly; PR Newswire; U.S. Energy Information Administration, World Markets Online.

ECONOMIC OVERVIEW

Finance Minister: Silvan Shalom

Currency: New Israeli Shekel (NIS)

Market Exchange Rate

(5/15/02): US$1 = NIS 4.89

Gross Domestic Product (GDP) (2001E):

$110.4 billion

Real GDP Growth Rate (2001E): -0.6%

(2002F): No growth or possibly -2%

Per Capita GDP (2001E):

$16,946

Inflation Rate (consumer prices, 2001E): 1.1%

(2002F): 4%-7%

Major Trading Partners: USA, European Community

Merchandise Exports (2001E): $27.4 billion

Merchandise Imports

(2001E): $30.9 billion

Major Export Products: Machinery and

equipment, cut diamonds, chemicals, textiles and apparel, agricultural products

Major Import Products: Military equipment, investment goods, rough

diamonds, oil, consumer goods

Current Account Balance (2000E): -$1.7

billion

Number of Tourists (2000E): 2.65 million

(2001E): 1.22 million

Unemployment Rate (2000E): 8.8%

(Fourth Quarter, 2001E): 10.2%

Total External Debt (2001E):

$43.2 billion

Foreign Investment (2001E): $3.9 billion

(down from a record $11.2 billion in 2000)

Foreign Exchange Reserves

(excluding gold) (2001E): $23.4 billion

ENERGY OVERVIEW

Infrastructure Minister: Avigdor

Lieberman

Proven Oil Reserves (1/1/02E): 3.8 million barrels

Oil Production (2001E) : 200 barrels per day (bbl/d)

Oil

Consumption (2001E): 278,000 bbl/d

Net Oil Imports (2001E):

278,000 bbl/d

Crude Oil Refining Capacity (1/1/02E): 220,000

bbl/d

Coal Consumption (2000E): 10.0 million short tons (all of which

is imported)

Natural Gas Reserves (1/1/02E): 1,470 billion cubic feet

(Bcf) (Note: This figure includes the major recent offshore gas find)

Natural Gas Consumption/Production (2000E): 0.35 Bcf

Electric

Generation Capacity (2000E): 9.1 gigawatts (70% coal-fired; 25% fuel oil; 5%

gasoil and IPPs)

Electricity Generation (2000E): 41.4 billion

kilowatthours

ENVIRONMENTAL OVERVIEW

Minister of

Environment: Tzahi Hanegbi

Total Energy Consumption (2000E): 0.8

quadrillion Btu* (0.2% of world total energy consumption)

Energy-Related

Carbon Emissions (2000E): 16.7 million metric tons of carbon (0.3% of world

total carbon emissions)

Per Capita Energy Consumption (2000E): 129.1

million Btu (vs U.S. value of 351.1 million Btu)

Per Capita Carbon

Emissions (2000E): 2.8 metric tons of carbon (vs U.S. value of 5.6 metric

tons of carbon)

Energy Intensity (2000E): 7,351 Btu/ $1995 (vs U.S.

value of 10,919 Btu/ $1995)**

Carbon Intensity (2000E): 0.16 metric

tons of carbon/thousand $1995 (vs U.S. value of 0.17 metric tons/thousand

$1995)**

Sectoral Share of Energy Consumption (1998E): Transportation

(32.7%), Industrial (33.7%), Residential (23.5%), Commercial

(10.1%)

Sectoral Share of Carbon Emissions (1998E): Transportation

(33.7%), Industrial (35.2%), Residential (18.5%), Commercial (12.5%)

Fuel

Share of Energy Consumption (2000E): Oil (70%), Coal(30%)

Fuel Share

of Carbon Emissions (1999E): Oil (61.5%), Coal (38.5%), Natural Gas

(0.0%)

Renewable Energy Consumption (1998E): 65 trillion Btu* (4%

increase from 1997)

Number of People per Motor Vehicle (1998): 3.8 (vs

U.S. value of 1.3)

Status in Climate Change Negotiations: Non-Annex I

country under the United Nations Framework Convention on Climate Change

(ratified June 4th, 1996). Signatory to the Kyoto Protocol (signed December

16th, 1998- not yet ratified).

Major Environmental Issues: Limited

arable land and natural fresh water resources pose serious constraints;

desertification; air pollution from industrial and vehicle emissions;

groundwater pollution from industrial and domestic waste, chemical fertilizers,

and pesticides.

Major International Environmental Agreements: A party

to Conventions on Biodiversity, Climate Change, Desertification, Endangered

Species, Hazardous Wastes, Nuclear Test Ban, Ozone Layer Protection, Ship

Pollution and Wetlands . Has signed, but not ratified, Marine Life

Conservation.

* The total energy consumption statistic includes petroleum, dry natural gas,

coal, net hydro, nuclear, geothermal, solar, wind, wood and waste electric

power. The renewable energy consumption statistic is based on International

Energy Agency (IEA) data and includes hydropower, solar, wind, tide, geothermal,

solid biomass and animal products, biomass gas and liquids, industrial and

municipal wastes. Sectoral shares of energy consumption and carbon emissions are

also based on IEA data.

**GDP based on EIA International Energy Annual 2000

ENERGY INDUSTRIES

Organization: Isramco

- private company, responsible for exploration and production; Oil

Refineries Limited - Part privatized, runs Israel's 2 refineries at Haifa

and Ashdod; Paz Oil, Delek, and Sonol - Israel's three largest oil

retailers; National Coal Supply Corporation - government-owned company

responsible for Israel's coal supply; Israel Electric Corporation Ltd. -

state company responsible for Israel's electric power supply.

Major

Ports: Ashdod, Haifa

Major Oil and Gas Fields: N.A.

Major

Pipelines: Tipline - 800,000 bbl/d (Eilat-Ashkelon-Haifa); Tapline - closed

(Ras Tanura - Haifa)

Major Refineries (crude refining capacity): Haifa

(130,000 bbl/d); Ashdod (90,000 bbl/d)

Links to other U.S. government sites:

CIA 2001 World

Factbook - Israel

Israel, the West Bank

and Gaza Consular Information Sheet

U.S. State Department

Background Notes on Israel

U.S. Department of Energy

Office of Fossil Energy -- Israel Page

U.S.

International Trade Administration, Country Commercial Guide - Israel

U.S. Embassy in Israel

Israeli Embassy in the United States

Library of Congress Country Study

on Israel

The following links are provided solely as a service to our customers, and therefore should not be construed as advocating or reflecting any position of the Energy Information Administration (EIA) or the United States Government. In addition, EIA does not guarantee the content or accuracy of any information presented in linked sites.

The Center for

Middle Eastern Studies - Israel

Address and Phone information for

the Ministry of Energy and Infrastructure

Israel Export

Institute

Israeli

Ministry of Finance

Bank

of Israel

Israel News

Agency

CountryWatch --

Israel

Israel

Government Gateway

Jerusalem

Post

Israel Ministry of

Foreign Affairs

Ha'aretz English

Edition

Israel Electric

Homepage

If you liked this Country Analysis Brief or any of our many other Country Analysis Briefs, you can be automatically notified via e-mail of updates. Simply click here, select "international" and the specific list(s) you would like to join, and follow the instructions. You will then be notified within an hour of any updates to our Country Analysis Briefs.

Return to Country Analysis Briefs home page

File last modified: May 15, 2002

Contact:

Lowell Feld

mailto:lfeld@eia.doe.gov

Phone: (202)586-9502

Fax: (202)586-9753

URL: http://www.eia.doe.gov/cabs/israel.html

If

you are having technical problems with this site, please contact the EIA

Webmaster at wmaster@eia.doe.gov